“Vehicle intelligentialisation” is the new buzz term in technology. It is the driver for the vehicle-to-everything (V2X) industry, which has huge growth opportunities as China undergoes rapid urbanisation and there is a need for improved transport and smarter mobility systems in the country. Here we talk about the future of V2X and what it means for China.

What is V2X?

Vehicle-to-everything (V2X) is communication between a vehicle and any entity that may affect, or may be affected by, the vehicle [1]. Traditionally, V2X is regarded as a vehicular communication system that incorporates various types of communications including V2V (vehicle-to-vehicle), V2I (vehicle-to-infrastructure), V2N (vehicle-to-network), V2P (vehicle-to-pedestrian), V2D (vehicle-to-device) and V2G (vehicle-to-grid). Recently, the concept of “vehicle intelligentialisation” has been introduced to the area of V2X, which promises huge commercial interest. From a global perspective, the V2X market is estimated to be USD 700 million as of this year and projected to reach USD 13 billion by 2028, growing at a CAGR of 44% [2]. Based on a report by Strategy& [3] (the strategy consulting team at PwC), China will continue having the highest growth rates of new vehicle sales and connected vehicle penetration. From 2020 to 2025, annual new vehicle sales are expected to grow from 22 to 28 million in China. That is an annual growth rate of 27%, compared to 23% in America and 21% in Europe. China’s connected vehicle penetration rate stands at 44% as of now and will increase to 91% in 2025. Demand for increased connectivity will continue to rise as China undergoes rapid urbanisation, bringing along with it an increasing concern for road safety, traffic efficiency and energy savings.

Smart Mobility and the future of V2X

In the Smart Mobility era, the V2X industry is undergoing rapid change, with four major trends:

- More flexible mobility models: Multiple models of transportation will enable travelers to choose the best option for a door-to-door planned route. Traditionally, transportation is segmented into two areas: private car ownership and public transportation systems – which includes bus, rail and taxi services. Recently, commuters are willing to take other adaptive forms, including bicycles (regular, electric, foldable), scooters and even walking. We call this phenomenon “Smart Mobility”. Furthermore, users have the option to own or share. With the rising need for Smart Mobility and a sharing economy, a variety of app-based mobility services will further enable commuters to seamlessly switch between car-sharing, riding the subway, cycling and walking — in safer and more sustainable ways.

- Increased connectivity and more robust ICT infrastructure: Cloud computing, AI, 5G, IoT sensors and other ICT infrastructure are needed to process the vast amounts of data collected in real time. This will then be used to provide the most effective mobility services to businesses and citizens alike. At present, V2X communication is predominantly V2V, V2I, V2N and V2P. In the next phase of V2X development, we will see growth in V2D and V2G communication, which will create next-generation in-vehicle and on-the-go experiences. With such interconnectivity, users will be able to control smart homes or work remotely via V2X communication. Our work and lifestyles will also be transformed. This is a huge market opportunity for start-ups working on in-vehicle digital services. Furthermore, connected vehicles will generate large amounts of data. This data will only continue to grow with the proliferation of autonomous vehicles and is estimated to reach over 4 TB per day [4] by 2023. We can expect to see new business opportunities emerging for cloud computing, big data, AI and advanced cybersecurity with new information about users and their behaviours.

- Improved road safety: It’s well known that human error is far more likely to cause accidents than overtly dangerous driving, which is why road safety is driving the development of connected vehicles. Traditional car OEMs pay more attention to how to improve road safety for all road users, including drivers, motorcyclists, bicyclists and pedestrians. Connected vehicle technology using 4G and soon to be 5G, will be vital for making roads safer in the interim, by securely exchanging information such as speed, acceleration, position and direction of travel, quickening response times to events on the road. Telstra and Lexus Australia worked together with Ericsson to start testing C-V2X (cellular-vehicle-to-everything) technology to improve road safety. In 95% of trials, the technology demonstrated end-to-end latency of data transfer at less than 50 ms [5]. V2X communication is heading to mass-market adoption as the world’s largest OEMs announced intentions to equip their new car models with this technology.

- Green mobility: With more and more commuters, V2X has a role in reducing travel time, improving energy efficiency and reducing human impact on the environment. This technology will be vital to optimise traffic flow, largely through the increased use of next-generation smart traffic lights. Improved traffic fleet management could avoid congestion, pollution emissions and enhance in-vehicle experiences. Urban planners and those involved in infrastructure development are keen on incorporating these data-driven traffic control systems.

The role of national policy in promoting V2X development

Relevant Chinese ministries have issued a number of V2X development promotion policies, encouraging industry growth. These representative policies are:

- Strategy for Innovation and Development of Intelligent Vehicles (NDRC [2020], No.202): The blueprint for developing technology, standards, applications, services and security.

- National ICV Industry Standards System Construction Guideline (Ministry of Industry and Information Technology [MIIT], 2018): Implementing a comprehensive standards system which will cover all aspects of the ICV [6]

- Administrative Regulations on the Use of 5905-5925 MHz Frequency Band in Direct-Link Communication of Internet of Vehicles (MIIT [2018], No.203): Defines the frequency range used for a vehicular communication system, confirming that LTE-V [7] will be the mainstream technology for V2X in China. Huawei is a prime player in this sector.

- Guiding Opinions on Promoting the Construction of New Infrastructure in the Transportation Field (MOT [2020], No.75): By 2035, achieving significant results in the construction of new infrastructure in the transportation field and the gradual implementation of autonomous vehicles.

At present, the V2X industry value chain, including communication chipsets, modules, terminals, protocol stacks, security chipsets, intelligent roads, infrastructure and so on, has been developing. China already has the industrialisation capabilities required to move this off the ground. The main players in China’s V2X Industry are shown in the table below.

Challenges in developing V2X

The optimal V2X system can integrate multiple vehicles, multiple users, multiple objects and networks and always provide the most connected and flexible communication capabilities. However, this network system is not yet available. There are several factors which are limiting the development of V2X communication.

- Efficient wireless access solutions: This is the foundation of credible V2X communication. The number and types of sensor elements in vehicles are continually increasing. The signing of the different message types and the integration of the certificates expand the message size tenfold, which causes message collisions on wireless communication channels. It’s a big challenge that is preventing the smooth transfer of huge volumes of data between vehicles and external devices. Another competitive field is the communication standard and related infrastructures. LTE-V2X has a technical advantage over 802.11p, while the commercial availability of LTE-V2X isn’t as well developed as 802.11p. China and Europe jointly lead the LTE-V2X standards, while the 802.11p standard and IP are mainly controlled by the U.S.

- Security and privacy issues: Holistic security markets cover processing, networks, gateways and interfaces. Various in-vehicle interfaces, such as Bluetooth, WiFi hotspots and USB connectivity, are key technologies considered with respect to security. Security is an important issue for V2X, especially for autonomous vehicles. Furthermore, privacy is essential to ensure acceptance by users. Currently, one solution to protect users’ privacy is to sign messages using temporary identifiers, namely pseudonyms. However, a simple periodic change would be easy to circumvent, therefore, more advanced pseudonym change strategies and solutions need to be developed.

- Customers’ willingness to pay for in-vehicle digital services: According to the report by Strategy&, customers are willing to pay for connected vehicle services, but the level of customers’ willingness to pay might be lower than OEMs’ expectations. Business-model innovation, customer-centric designs and digital service distributions are key factors which will decide the return of investments in the V2X industry.

Commercial opportunities in the V2X industry

The V2V (vehicle-to-vehicle) communication segment is expected to hold the largest share of the automotive V2X market [8]. This is driven by the need for increased vehicle safety, a major concern among the public and government because of the increasing number of traffic accidents. As the Chinese government is promoting V2X development, based on the aforementioned Strategy for Innovation and Development of Intelligent Vehicles, till 2025, intelligent vehicles with conditional autonomy will be spawned, LTE-V2X and other networks will be regionally viable, 5G-V2X will be progressively available on expressways and in some cities and the high-precision, spatial-temporal data service network will be fully covered.

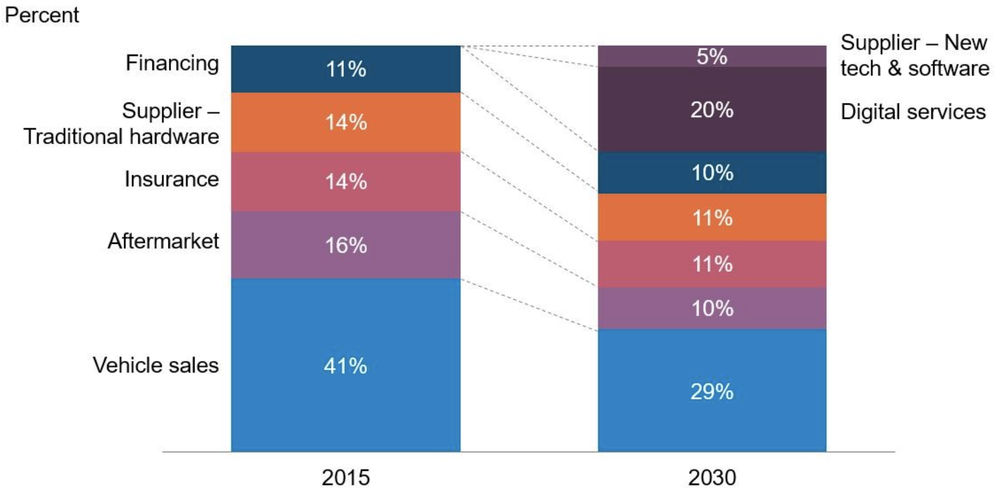

With increasing connectivity and bandwidth, in-vehicle digital services are expected to grow significantly and become the second largest profit pool of the global automotive value chain by 2030. It is estimated that in 10 years’ time, the digital services segment will represent 20% of the global auto industry profit, as shown in the chart below [9].

References

- [1] Wikipedia

- [2] Automotive V2X Market by Connectivity, Communication, Vehicle, Propulsion, Unit, Offering, Technology, and Region – Global Forecast to 2028, Markets and Markets.

- [3]《2020年数字化汽车报告 中国市场解读篇》,普华永道思略特&中国电动汽车百人会。

- [4] Source: Inter

- [5] https://www.ericsson.com/en/networks/cases/cellular-v2x-creating-safer-roads

- [6] Intelligent Connected Vehicles, ICV

- [7] Long-term evolution-vehicle (LTE-V): A Cellular-Assisted V2X Communication Technology

- [8] Automotive V2X Market by Connectivity, Communication, Vehicle, Propulsion, Unit, Offering, Technology, and Region – Global Forecast to 2028, Markets and Markets.

- [9] Statista: Global Automotive Industry Profit Pool by Segment in 2021, With a Forecast for 2035